Scinai Publishes Q2 2024 Financial Results and Provides Business Update; Restructures $29 Million Bank Loan to Equity; On Track to Regain Nasdaq Compliance by August 23

JERUSALEM , Aug. 14, 2024 /PRNewswire/ -- Scinai Immunotherapeutics Ltd. (Nasdaq: SCNI) ("Scinai", or the "Company"), a biopharmaceutical company focused on developing inflammation and immunology (I&I) biological products and on providing CDMO services through its Scinai Bioservices business unit, today published its financial results for the quarter ended June 30, 2024 and provided a business update. The Company will hold a webinar covering its Q2 2024 financial results and business update on August 20th at 11AM EDT/18:00 Israel time. Registration for the webinar can be done using the following LINK.

Business Update & Recent Highlights

Conversion of EIB Loan into Equity and Regaining Nasdaq Compliance

On June 7, 2024, the Company announced that on June 5, 2024, it had received formal notification from the Listing Qualification Department (the "Staff") of the Nasdaq Stock Market ("Nasdaq") that the Company remains non-compliant with the requirement in Listing Rule 5550(b)(1) that a company have stockholders' equity of at least $2.5 million, or any of the alternative requirements under Nasdaq Listing Rule 5550(b). Accordingly, on June 18, 2024, the Company presented its plan to get back into compliance with the equity requirement with the Nasdaq Hearing Panel. The plan presented to the panel included a debt-to-equity loan restructuring deal between the Company and the European Investment Bank (the "EIB").

On July 3rd, the Company announced that the Hearings Panel had determined to grant the Company's request to continue its listing on The Nasdaq Stock Market, subject to the Company meeting certain conditions, including filing on or before August 14, 2024, a public disclosure demonstrating compliance with the Equity Requirement.

On August 13, 2024, the Company announced that it had signed a Loan Restructuring Agreement, which included an amendment and restatement to the amended Finance Contract with the EIB. The closing of the transaction is subject to customary closing conditions. In connection with the transaction, an amount equal to approximately EUR 26.6 million (equal to approximately $29 million), including interest accrued to date, owed by the Company to the EIB under the amended Finance Contract between the parties will be converted into 1,000 preferred shares, no par value per share, of the Company (the "Preferred Shares"). Following such conversion, the total outstanding amount owed by the Company to the EIB will be EUR 250,000 (equal to approximately $273,000). The outstanding amount will have a maturity date of December 31, 2031, will not be prepayable in advance, and no interest accrues or is due and payable on such amount.

As a result of the transactions under the Restructuring Agreement the Company believes that not only it now has stockholders' equity substantially above the $2.5 million as required by Nasdaq Listing Rule 5550(b)(1) but that, based on its unaudited proforma analysis, it will be able to maintain compliance for at least 12 months going forward.

On August 14th, the Company submitted the required documents to demonstrate compliance with the Equity requirement to the Nasdaq Hearing Panel and is now awaiting notification from the Staff.

CDMO business unit

Since Jan 2024 we received CDMO work orders valued at approximately $600K, and we are in advanced contract discussions with several other potential clients. We maintain confidence in our sales guidance for 2024 of $1.25 million in expected revenues. As our CDMO unit is new and we are in a rapid growth stage, acquiring new clients and building our reputation and brand awareness of our CDMO services, we expect revenues from the CDMO business to increase materially in the coming years. This is also coupled with growing demand for boutique CDMO services from early-stage biotech companies looking for fast project onset at competitive pricing without compromising on meeting the most stringent scientific and quality standards.

In addition, in 2024 we have been pursuing extensive targeted marketing activities, including online advertisements, direct outreach campaigns and participation in major pharmaceutical conferences, such as BIO Europe Spring in Barcelona (March 2024), and the BioMed Israel conference in Tel Aviv, Israel (May 2024), at which we marketed our CDMO services and met potential partners for our R&D pipeline and potential investors.

Our CDMO unit is currently focused both on executing drug development projects for our clients and on validating our processes and facilities to be ready for cGMP inspection by the Israeli Ministry of Health.

In June, we held a first of its kind, hands on aseptic processing course at our facility in Jerusalem in collaboration with key figures in the industry including Ms. Rachel Shimonovitz, Head of GMP inspectorate of the Israeli Ministry of Health, and ADRES Int'l Biotech, a leading Israeli regulatory and quality consulting services firm. The course attracted many senior role holders from the Israeli biotech industry who came to our facility for this two-day education and training course.

Pipeline Development

We are aggressively advancing the NanoAb preclinical development. At the end of April 2024, we concluded an in-vivo proof of concept animal study in collaboration with Prof. Amos Gilhar, a world-renowned dermatologist of the prestigious Technion Israel Institute of Technology.

On July 15th we announced promising results as the statistical analysis of psoriasis markers measured in the study confirmed that the effect of Scinai's NanoAb was similar to that of the two comparator drugs, supporting the hypothesis that intralesional injection of a nanoAb blocking the IL-17 cytokine can positively impact the inflammatory cytokine cascade, and lead to reduction in psoriatic lesion severity and improvement of the skin's integrity. By delivering a biological treatment directly into psoriatic lesions, Scinai aims to improve disease management for patients suffering from mild to moderate plaque psoriasis by offering the high potency and specificity advantages reserved for biologic drugs while providing a safer and more convenient treatment option compared to existing therapies currently offered to this patient category.

On June 4, 2024, we met for a scientific advisory meeting with the Paul Erlich Institute (the PEI) of Germany, the scientific advice of which is considered acceptable guidance for IMPD filing with the European Medicines Agency (EMA) and is also considered the European comparable to a pre-IND meeting with the FDA in the U.S.

Consequently, on July 23rd we announced the receipt of positive regulatory feedback from the PEI for our drug development program towards Phase 1/2a clinical trial of our anti-IL-17A/F nanoAb (SCN-1) in Plaque Psoriasis. The minutes of meeting clarified our preclinical toxicology and clinical program for Plaque Psoriasis with intralesional injections for the treatment of patients with mild to moderate Plaque Psoriasis. The PEI had requested to see data of efficacy in blocking IL-17F and this data became available as per the Company's announcement on July 15th describing the positive in vivo proof of concept results. The PEI accepted the Company's position that toxicology studies can be conducted in pigs rather than in Non-Human Primates. The PEI also accepted the Company's position to compare the SCN-1 to placebo directly in patients with mild to moderate plaque psoriasis while skipping the need for testing in healthy volunteers, resulting in a phase 1/2a clinical trial, which will assess both safety and efficacy in the same trial. Moreover, the PEI agreed to compare SCN-1 to placebo on the same human subject, a strategy that could significantly reduce the number of patients required for the clinical trial. Last, the PEI commented that the manufacturing process looks well developed and that controls and specifications presented are acceptable.

The Phase 1/2a study is expected to include approximately 24 plaque psoriasis patients and is expected to commence in the second half of 2025 with readout in 2026

Additional NanoAbs for treatment of additional autoimmune diseases, such as asthma, atopic dermatitis and wet AMD, have been discovered and characterized at Max Planck and University Medical Center Göttingen as part of their research collaboration agreement with Scinai. Scinai holds exclusive options for exclusive licenses at pre-agreed financial terms for each of the resulting NanoAbs.

We are pursuing strategic partnerships and sublicensing options for both our COVID-19 self-administered inhaled NanoAb, which demonstrated highly promising in vivo results in animals as both a therapeutic and prophylactic treatment, and our anti-IL-17 nanoAb for the treatment of plaque psoriasis and other potential indications.

Q2 2024 Financial Summary

R&D expenses for the six months ended June 30, 2024, amounted to $2,788 thousand, compared to $3,449 thousand for the six months ended June 30, 2023. The decrease was primarily due to a reduction in salaries and reduced use of subcontractors.

Marketing, general and administrative expenses for the six months ended June 30, 2024, amounted to $1,003 thousands, compared to $2,332 thousands for the six months ended June 30, 2023. The decrease was primarily due to a reduction in salaries, share-based compensation and professional services.

Financial expenses for the six months ended June 30, 2024, amounted to $526 thousand compared to $1,496 thousand for the six months ended June 30, 2023.

Net loss for the six months ended June 30, 2024, was $4,481 thousand compared to net loss of $7,277 thousand for the six months ended June 30, 2023.

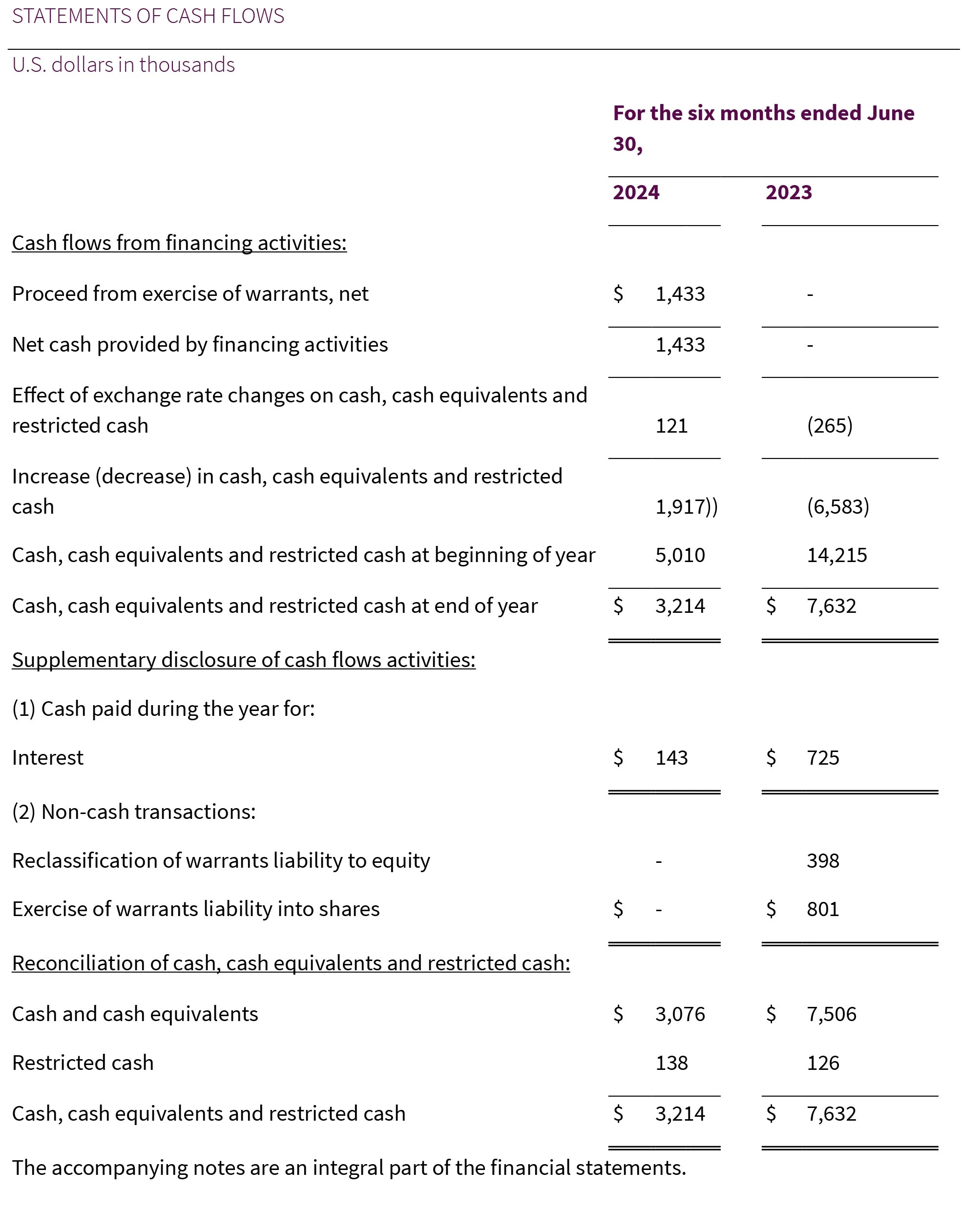

As of June 30, 2024, Scinai had cash and cash equivalents and short-term deposits of $3,214 thousands compared to $7,632 thousand as of June 30, 2023.

BALANCE SHEETS

BALANCE SHEETS

STATEMENTS OF OPERATIONS

STATEMENTS OF OPERATIONS

STATEMENTS OF COMPREHENSIVE LOSS

STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY

STATEMENTS OF CASH FLOWS

STATEMENTS OF CASH FLOWS

About Scinai Immunotherapeutics

Scinai Immunotherapeutics Ltd. (Nasdaq: SCNI) is a biopharmaceutical company with two complementary business units, one focused on in-house development of inflammation and immunology (I&I) biological therapeutic products beginning with an innovative, de-risked pipeline of nanosized VHH antibodies (NanoAbs) targeting diseases with large unmet medical needs, and the other a boutique CDMO providing biological drug development, analytical methods development, clinical cGMP manufacturing, and pre-clinical and clinical trial design and execution services for early stage biotech drug development projects.

Company website: www.scinai.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Litigation Reform Act of 1995. Words such as "expect," "believe," "intend," "plan," "continue," "may," "will," "anticipate," and similar expressions are intended to identify forward-looking statements. All statements, other than statements of historical facts, are forward-looking statements. Examples of such statements include, but are not limited to, the ability of the Company to [regain and] remain compliant with the continued listing standards of Nasdaq, the potential of Scinai's NanoAb program, expected revenues of Scinai's CDMO business and timing of pre-clinical and clinical studies of the Company's anti-IL NanoAbs for the treatment of plaque psoriasis and their results. These forward-looking statements reflect management's current views with respect to certain current and future events and are subject to various risks, uncertainties and assumptions that could cause the results to differ materially from those expected by the management of Scinai Immunotherapeutics Ltd. Risks and uncertainties include, but are not limited to; the risk that the Company will otherwise be unable to [regain compliance] and remain compliant with the continued listing requirements of Nasdaq; lower than anticipated revenues of Scinai's CDMO business in 2024 and thereafter, failure to sign agreements with other potential clients of the CDMO business; a delay in the commencement and results of pre-clinical and clinical studies, the risk of delay in, Scinai's inability to conduct, or the unsuccessful results of, its research and development activities, including the contemplated in-vivo studies and a clinical trial; the risk that Scinai will not be successful in expanding its CDMO business or in-license other NanoAbs; the risk that Scinai may not be able to secure additional capital on attractive terms, if at all; the risk that the therapeutic and commercial potential of NanoAbs will not be met or that Scinai will not be successful in bringing the NanoAbs towards commercialization; the risk of a delay in the preclinical and clinical trials data for NanoAbs, if any; the risk that our business strategy may not be successful; Scinai's ability to acquire rights to additional product opportunities; Scinai's ability to enter into collaborations on terms acceptable to Scinai or at all; timing of receipt of regulatory approval of Scinai's manufacturing facility in Jerusalem, if at all or when required; the risk that the manufacturing facility will not be able to be used for a wide variety of applications and other vaccine and treatment technologies; and the risk that drug development involves a lengthy and expensive process with uncertain outcomes. More detailed information about the risks and uncertainties affecting the Company is contained under the heading "Risk Factors" in the Company's Annual Report on Form 20-F filed with the Securities and Exchange Commission ("SEC") on May 15, 2024, and the Company's subsequent filings with the SEC. Scinai undertakes no obligation to revise or update any forward-looking statement for any reason.

Company Contacts

Investor Relations | +972 8 930 2529 | ir@scinai.com

Business Development | +972 8 930 2529 | bd@scinai.com